The Value of Linking KPIs with KRIs

In today’s post-COVID era, emerging risks will continue to impact many areas. Government, healthcare, and pharmaceuticals will likely maintain a focus on strengthening their pandemic risk assessments. Other industries will focus on developing or enhancing their risk assessment plans to identify emerging threats within their supply chains and other areas.

In today’s post-COVID era, emerging risks will continue to impact many areas. Government, healthcare, and pharmaceuticals will likely maintain a focus on strengthening their pandemic risk assessments. Other industries will focus on developing or enhancing their risk assessment plans to identify emerging threats within their supply chains and other areas.

As powerful tools to support these initiatives, both Key Risk Indicators (KRIs) and Key Performance Indicators (KPIs) are metrics that can be used to monitor business performance and track potential risks.

4 Types of KPIs and KRIs

While you can map KPIs and KRIs to any aspect of your business, common types of them include:

- Financial

- KRIs: economic downturn, regulatory changes, acquisitions, budget changes

- KPIs: gross profit, EBITDA, debt to equity ratio, budget variance

- HR

- KRIs: high staff turnover, low staff satisfaction, leadership changes

- KPIs: retention rate, absenteeism rate, HR effectiveness, successor gap rate

- Operational

- KRIs: process inefficiencies, business process system failures, supplier issues

- KPIs: labor utilization, delivery on time in full, production system downtime, supplier lead time

- IT / Technological

- KRIs: IT system failures, data / security breaches, regulatory changes

- KPIs: server downtime, average time to repair, security-related downtime

The Difference Between KRIs and KPIs?

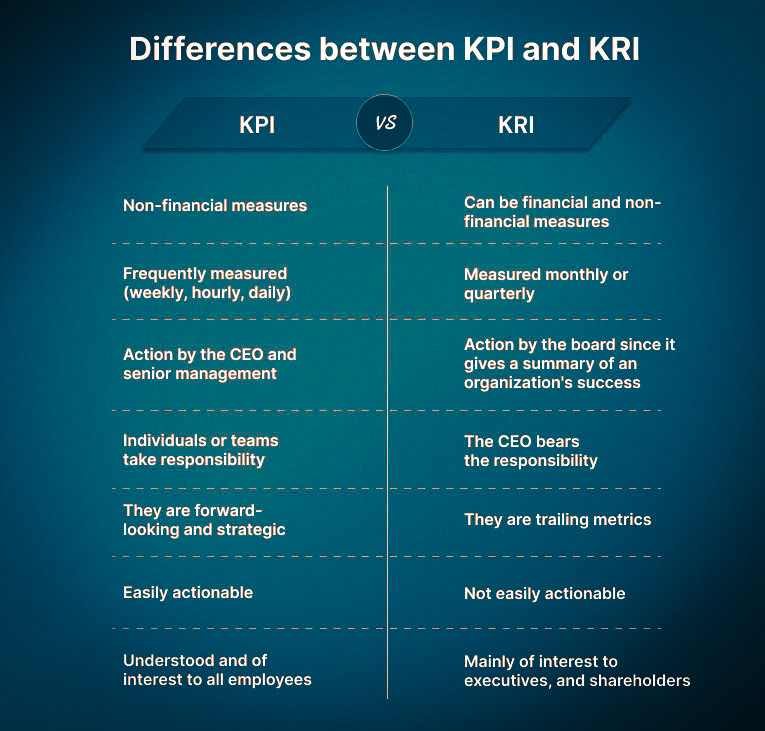

Not surprisingly, many question whether KRIs and Key Performance Indicators (KPIs) are one in the same. However, such is not the case because KRIs measure how risky an activity is and KPIs measure how effective the activity was performed.

KRIs provide an early warning to identify any potential event that may harm business continuity in the long term. In contrast KPIs are related to past activities, and they are done in the short term. KRIs are systemic in nature and typically monitored by governance and risk specialists, while management and operational specialists focus on KPIs, which address specific problems at a business unit or process level.

The Alignment of KPIs and KRIs

Although they are different, KRIs and KPIs should be closely linked. Unfortunately, though, they are often kept separate which isn’t favorable because you can’t discuss performance without discussing risk. With KPIs, you can easily see how you are doing against our goals; and with KRIs, you can determine the likelihood of achieving your goals or discovering what might prevent you from achieving them. As such, alignment between the two is warranted.

Following are a few examples that illustrate the KRI / KPI relationship:

- A KPI may be used to measure IT system performance while a complementary KRI tracks vulnerability to cyberattacks.

- A KPI may track market share growth with an associated KRI that monitors associated risks like downward customer purchasing trends or new competition.

- A KPI might measure staff engagement or satisfaction while monitoring the likelihood of losing key staff and risking labor shortages as KRIs.

As you can see, a decreased value in a KPI may increase the value of a related KRI if a company goal is not achieved. For instance, a year-over-year decrease in customer profitability (KPI) increases the chances that operations in the related business line will need to be discontinued (KRI). That’s why it’s important to link them in and track both performance and risk at the same time in one streamlined process.

Also, since KRIs feed into KPIs with each managed by a different team and requiring coordination, understanding the departmental relationships between those who monitor KPIs and related KRIs will naturally expand involvement across the enterprise.

Taking a Strategic Approach to KRI & KPI Development

When we work with clients, we generally start by identifying the business’s key goals. Then we develop KPIs that will monitor performance and tell us whether the business is on track against those goals. We also help our customers identify the key risks related to each goal and build KRIs to track those risks.

Once the KRIs and KPIs are in place, they are monitored and tracked regularly – some in real time, and others on a monthly or quarterly basis based on their relevancy to the business.

Fortunately, business analytics and reporting systems like Silvon Stratum can automate a good deal of the risk and performance measurement processes for businesses, no matter their size or industry.